Average Recovery Rate of a Collection Agency

Nexa Collect

FEBRUARY 3, 2022

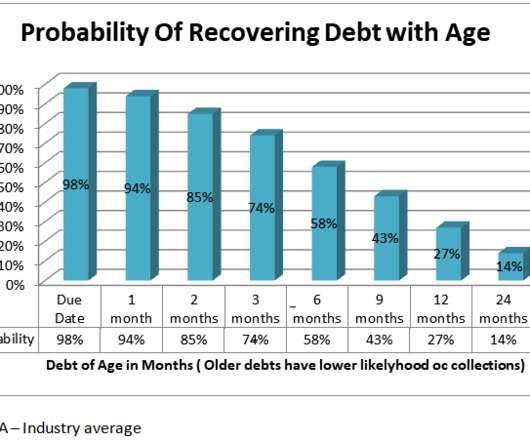

An average collection agency will recover about 20% of the total debt assigned. Here are the most important factors which decide how much a collection agency will collect for you: 1. Some clients may get a 100% recovery rate, for others it could very well be 0%.

Let's personalize your content