Saudi Credit Bureau Delivers Access To Loans For Millions with Score

Fico Collections

SEPTEMBER 15, 2022

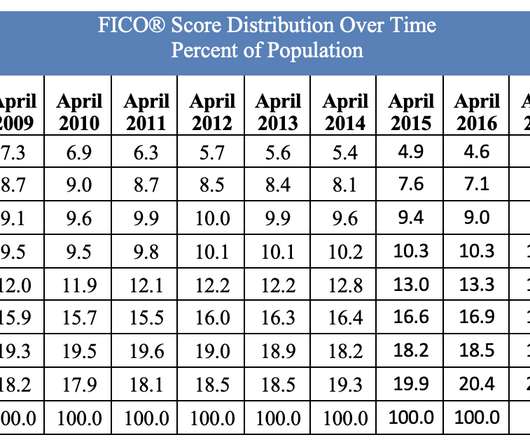

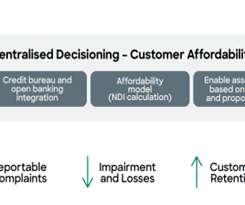

Saudi Credit Bureau Delivers Access To Loans For Millions with Score. Prior to the implementation, lenders in the region had been relying heavily on salary data to assess a consumer’s propensity to repay a loan. The adoption of the FICO® Score has allowed lenders to grow their portfolios and increase financial inclusion.

Let's personalize your content