Managing Cash Flow During Covid

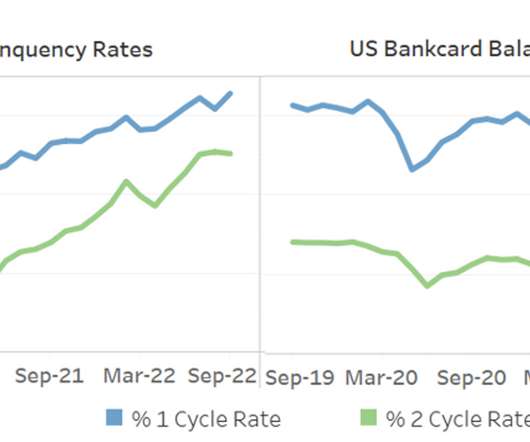

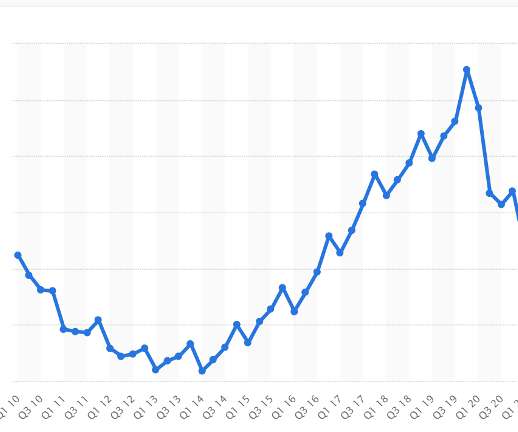

Debt Recoveries

AUGUST 29, 2021

Reading Time: 4 minutes Cash flow is having the right amount of cash in the right places at the right time, every time. This cash can be sourced from a few areas, such as capital investment, borrowings and the like, but the main way you want to generate cash is from profits. . Systems and Processes .

Let's personalize your content