Supreme Court says Congress must expand debt collection law

Roths Child Law

NOVEMBER 7, 2020

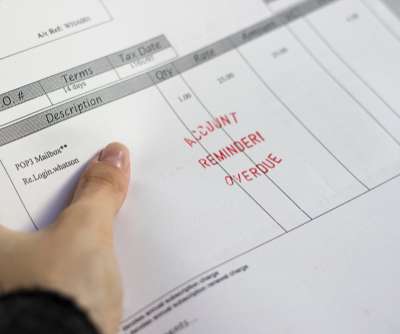

Congress needs to enact laws expanding consumer protections against abusive debt collection, the U.S. Tennessee residents may have heard about the case, which involved a class action filed by several people who defaulted on car loans. Debt obtained from bankrupted finance company. Supreme Court unanimously ruled in 2017.

Let's personalize your content