Daily Digest – October 3. Collector Not Obligated to Notify Creditor of Dispute; Legal Challenges to Student Loan Debt Cancellation Plan Launched

Account Recovery

OCTOBER 3, 2022

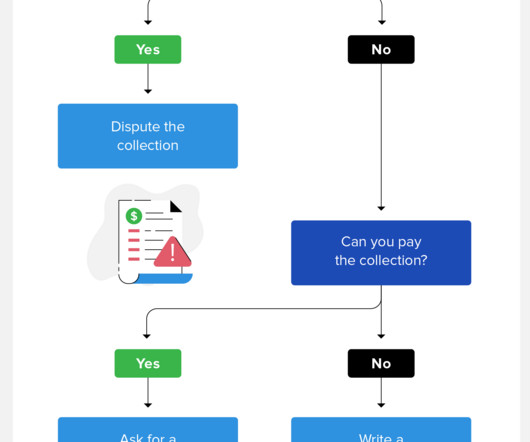

COLLECTOR NOT OBLIGATED TO NOTIFY CREDITOR OF DISPUTE A judge in Oklahoma has granted a motion to dismiss, ruling the defendant was not obligated under the Fair Debt Collection Practices Act to notify the original creditor that a debt was being disputed.

Let's personalize your content