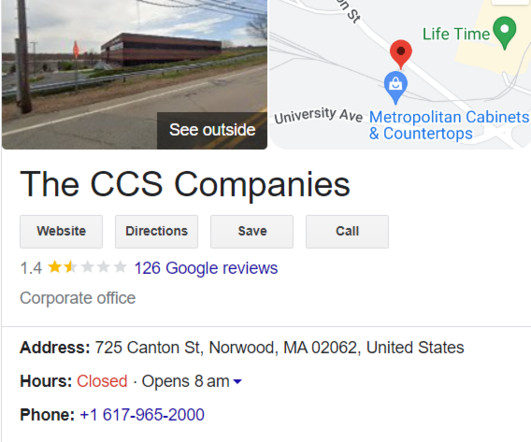

CMS Services Launches Free Terms & Conditions Database With Agreements From Hundreds of Creditors Nationwide

Account Recovery

APRIL 7, 2021

CHICAGO — April 6 — CMS Services, a leading provider of compliance management services to the Accounts Receivable Management industry, is excited to announce the launch of its Bank Terms & Conditions portal, providing copies of the terms and conditions issued by hundreds of credit grantors and financial institutions nationwide from (..)

Let's personalize your content