Unsecured Credit Cards for Bad Credit

Nerd Wallet

MAY 4, 2022

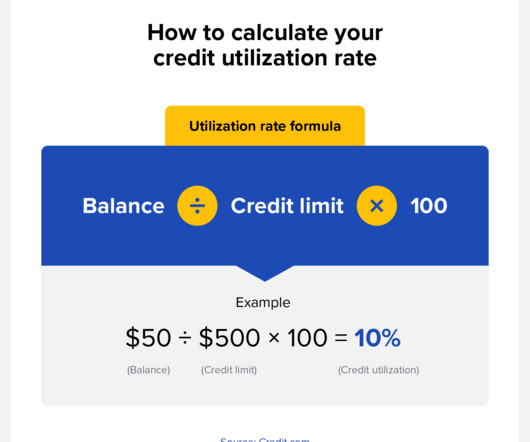

If you have bad credit (FICO scores of 629 or below) but hope to get a credit card, you have options. Your best bet is typically a secured credit card because you’ll provide an upfront deposit as collateral. Unsecured cards, on the other hand, don’t rely on collateral. As a result, it can be more. Twitter: @sarakrathner.

Let's personalize your content