Passage Of Debt Collection Bill Could Be A ‘Slippery Slope’ For Lenders

Collection Industry News

MAY 18, 2021

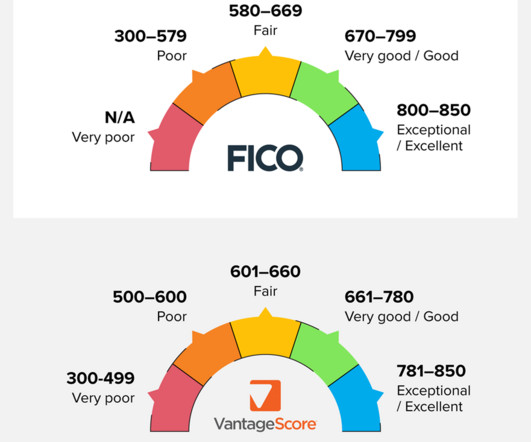

While consumer groups praised the bill for its recourse for consumers harassed by debt collectors, CUNA and NAFCU saw the bill as complicating the legal relationship between consumers, members and lenders. In the letter, Nussle stated, “Lenders rely on complete and accurate credit reports when underwriting loans.

Let's personalize your content