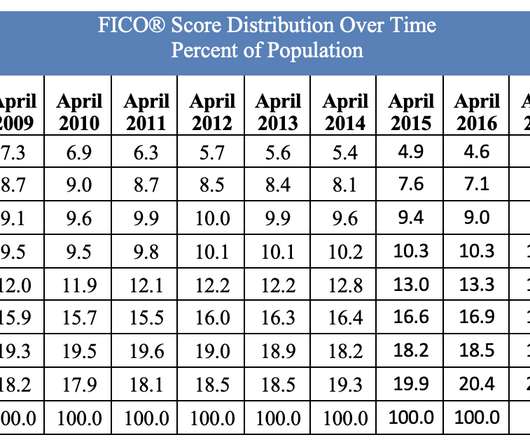

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

Fico Collections

AUGUST 16, 2021

“Amounts owed” comprises some 30% of the overall FICO® Score calculation and is heavily weighted towards credit card balances and utilization so the observed reduction in credit card debt is helping to drive scores upwards. Fewer consumers are actively seeking credit. There has been a 12.1% The Other Side of the Coin.

Let's personalize your content