How Often Do Debt Collection Agencies Take You To Court? 5 Things to Know

Taurus Collect

JUNE 12, 2023

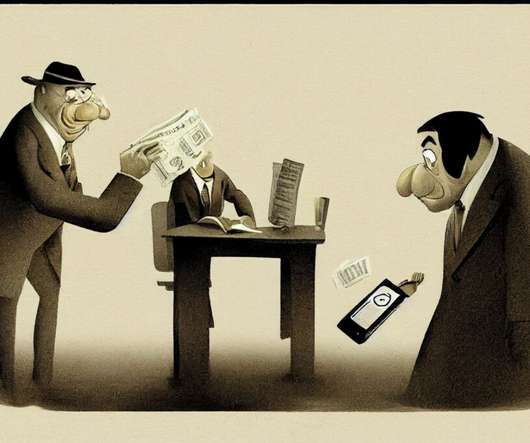

Thus, debt collection agencies are commonly utilised to ensure that funds due back to businesses don’t go unpaid. But how often do debt collection agencies take their clients’ customers to court? But did you know that these agencies often try to resolve your debt before resorting to legal action?

Let's personalize your content