Troutman Pepper Weekly Consumer Financial Services Newsletter

Troutman Sanders

NOVEMBER 13, 2023

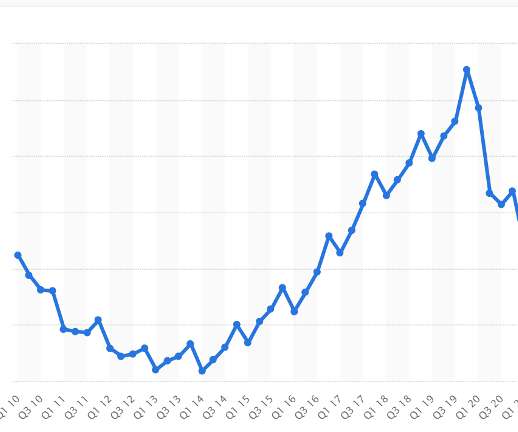

On November 8, while at the Central Bank of Ireland, Federal Reserve Governor Lisa D. Cook spoke about financial stability and how “asset valuations have generally risen notably above their historical levels” this year. For more information, click here. For more information, click here. For more information, click here.

Let's personalize your content