Government is Making Debt Recovery a lot Harder

Nexa Collect

JANUARY 14, 2023

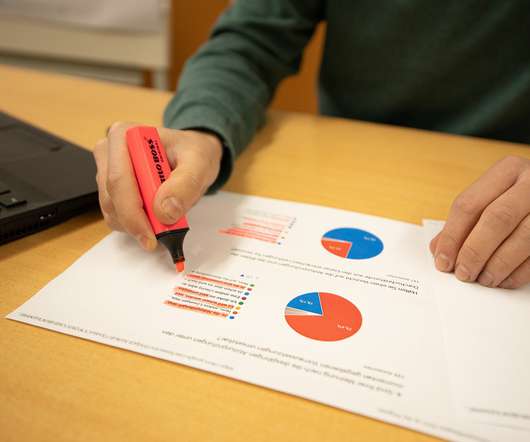

The US government has thrown a slew of laws on collection agencies, making bad-debt recovery harder and costlier. Lower recoveries mean, low recoveries and extensive loss for businesses and doctors. Our government’s intention behind these laws is not wrong, but the ground reality is different. . Extra costs to comply with these laws would be passed on to businesses /creditors, who are already unwilling to pay the current costs associated with hiring a professional debt collector.

Let's personalize your content