Why Hire Debt Collectors to Handle Your Delinquent Accounts

JMA

JULY 30, 2023

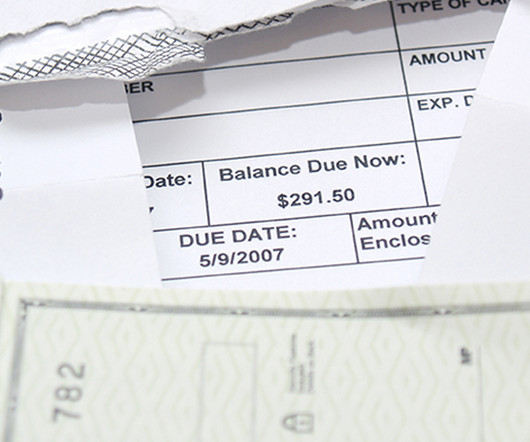

If your business has outstanding delinquent accounts, you may be wondering if it’s worth hiring a professional debt collector to handle them. The answer is yes! Hiring a professional debt collector is an effective way to collect on delinquent accounts and protect your bottom line. If you’re not sure where to start, contact us today. Read more » The post Why Hire Debt Collectors to Handle Your Delinquent Accounts appeared first on JMA Credit Control.

Let's personalize your content