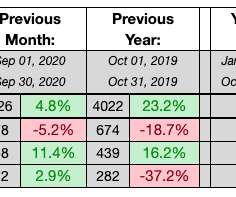

FDCPA Suits Continue Decline as FCRA and TCPA Suits Climb: WebRecon

Account Recovery

DECEMBER 4, 2020

Consumers and the attorneys who represent them in litigation against companies in the accounts receivable management industry continued to forgo the Fair Debt Collection Practices Act in favor of the Fair Credit Reporting Act and the Telephone Consumer Protection Act, according to data released by WebRecon. The number of FDCPA lawsuits trended downward in six … The post FDCPA Suits Continue Decline as FCRA and TCPA Suits Climb: WebRecon appeared first on AccountsRecovery.net.

Let's personalize your content