Government is Making Debt Recovery a lot Harder

Nexa Collect

JANUARY 14, 2023

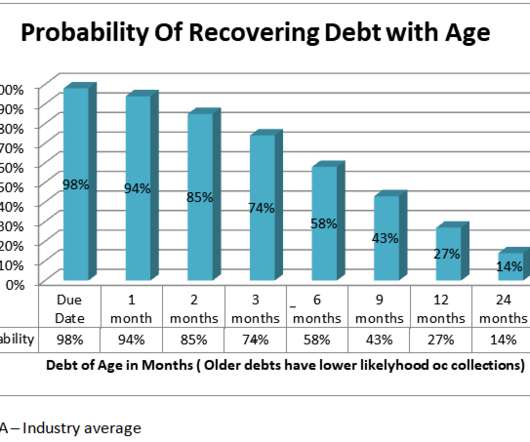

The US government has thrown a slew of laws on collection agencies, making bad-debt recovery harder and costlier. Our government’s intention behind these laws is not wrong, but the ground reality is different. . Debtors who would have usually paid quickly are now disputing the collection notices more than ever.

Let's personalize your content