Introduction to an ML-Powered Debt Management Approach

Qualco

DECEMBER 7, 2021

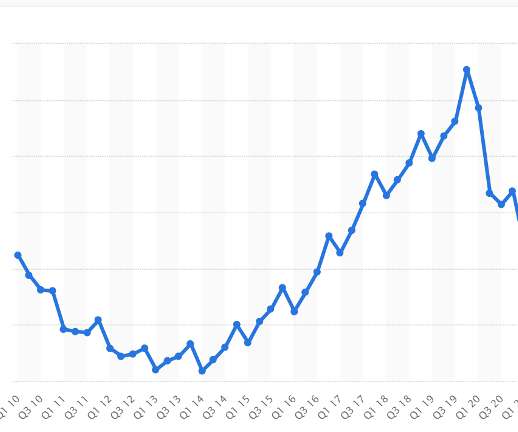

Reinventing the way financial institutions reach out to customers is an essential step towards a more efficient debt collection process. ML can lead to an optimised debt collection process not only by picking a different contact channel but also by providing insights on when to contact the customer and with what message.

Let's personalize your content