What is Debt Consolidation and How Does it Work?

Better Credit Blog

MAY 4, 2022

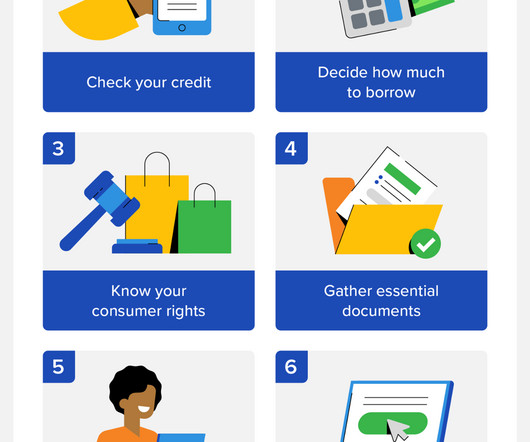

Debt consolidation is when you bundle several debts together into one larger sum and then make a single monthly repayment instead of multiple smaller ones. Consolidating debts with different interest rates and repayment schedules can make it easier to manage your finances. Debt Consolidation Guide.

Let's personalize your content