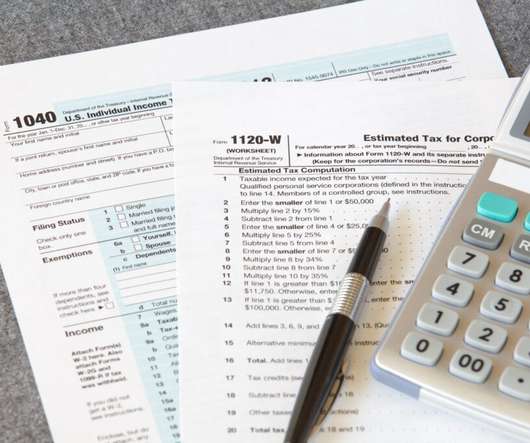

Can a Lender Pursue Debt Collection After a Charge Off and 1099-C Issuance?

Jimerson Firm

FEBRUARY 10, 2022

When account owners have an account that reflects a negative balance, the lender is faced with a myriad of options and obligations with regard to the pursuit of that debt. However, Florida courts have held that charged off debt is not forgiven, as may still be pursued for debt recovery and satisfaction.

Let's personalize your content