Over half of student loan borrowers racked up credit card debt during the payment pause—now experts worry about ‘shock’

Collection Industry News

AUGUST 6, 2023

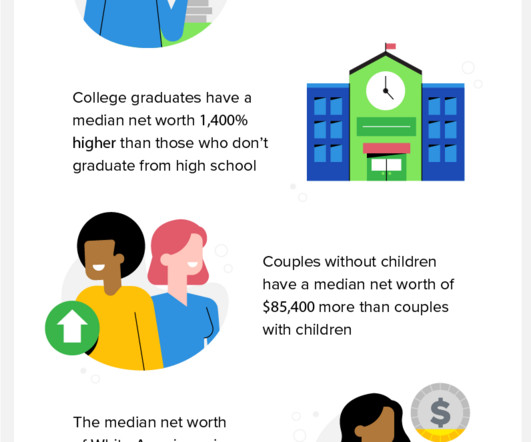

Federal student loan borrowers have had a break from paying back their student loans for over three years now. Though the forbearance may have given them breathing room, helped them add to their savings or pay down other debts, inflation creeping up throughout 2022 undermined a lot of that progress.

Let's personalize your content