How Late Can You Be on a Car Payment, Mortgage or Other Bill?

Credit Corp

JUNE 14, 2023

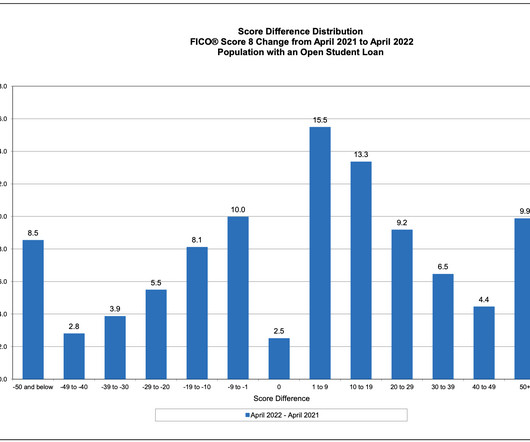

How Late Can You Be on Credit Card Payments? How Late Can You Be on Student Loans? Tips for Avoiding Late Fees Getting Late Payments off Your Credit Report How Late Can You Be on a Car Payment? Many lenders give borrowers a grace period before they technically consider the payment late.

Let's personalize your content