FICO Score 10 Suite Available from All Three Credit Bureaus

Fico Collections

DECEMBER 4, 2020

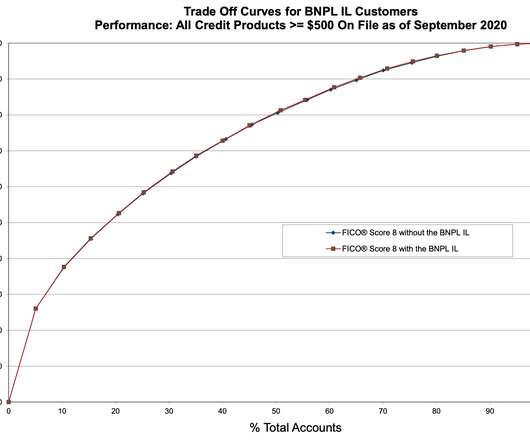

The FICO® Score 10 Suite outperforms all previous FICO Scores, giving lenders unparalleled predictive power to make more precise lending decisions. With the FICO® Score 10 Suite, lenders gain up to a ten percent predictive lift over previous FICO Score models.

Let's personalize your content