Profitability and Customer Financial Health in Retail Banking

Fico Collections

NOVEMBER 30, 2022

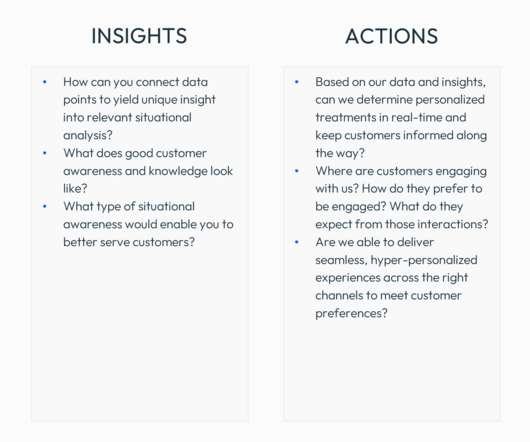

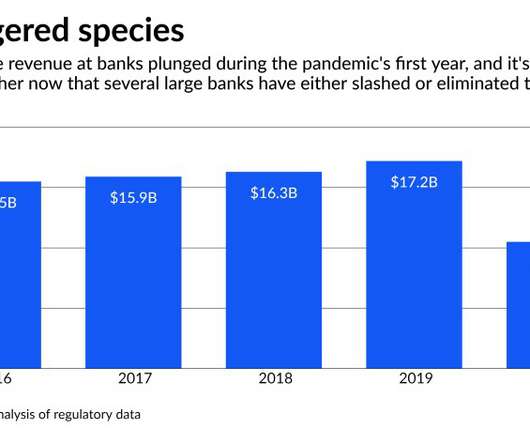

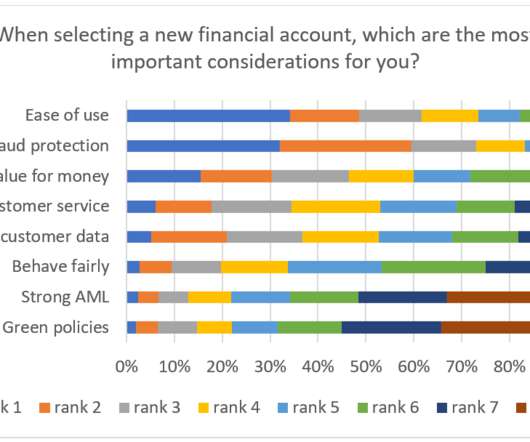

Profitability and Customer Financial Health in Retail Banking. In my recent Forbes article , I explored a vision for the future of retail banking where the customer’s complete financial wellness is at the center of decision making. For this, banks need a more robust model of financial wellness. FICO Admin.

Let's personalize your content