Paying Off Your Credit Card With a Personal Loan: Pros and Cons

Credit Corp

MAY 1, 2024

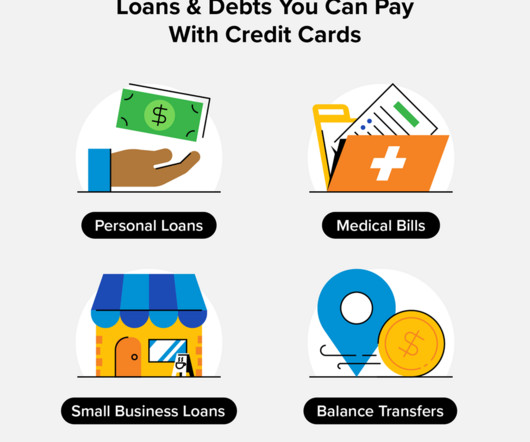

Paying off a credit card with a personal loan can offer the advantage of potentially lower interest rates, saving money on interest charges over time. However, the personal loan could come with origination fees or other charges that should be carefully considered. What Is a Personal Loan?

Let's personalize your content