Redefining Banking: A Conversation on the CFPB’s Proposed 1033 Rule

Troutman Sanders

JANUARY 18, 2024

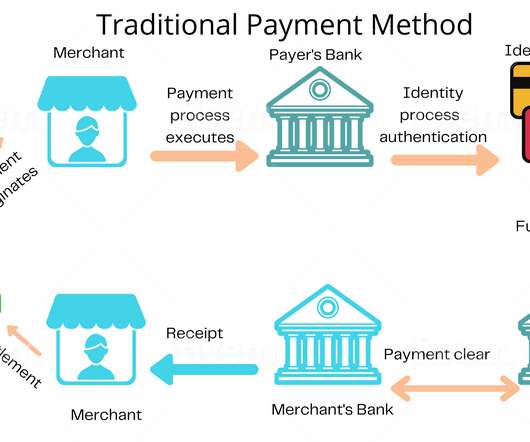

Transcript: Redefining Banking: A Conversation on the CFPB’s Proposed 1033 Rule (PDF) Jordan highlights the importance of data portability in banking, comparing it the telecommunications industry’s phone number portability. He suggests that the rule will increase competition, forcing banks to offer better services to retain customers.

Let's personalize your content