How To Deal with Debt Collectors When You Can’t Pay

Better Credit Blog

APRIL 4, 2022

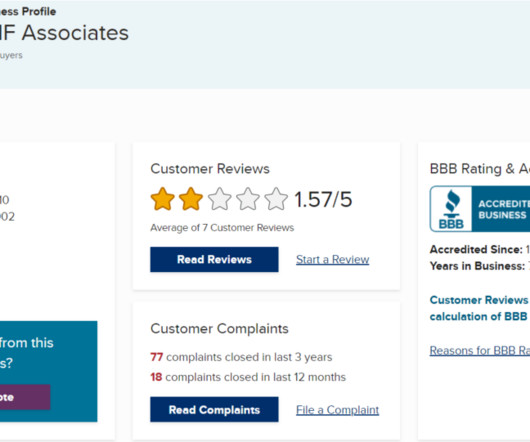

If you are like most people, you have dealt with or are currently dealing with debt collectors. I’ve been preaching about the dangers of debt collectors for years and get countless emails from readers who end up in trouble by answering the phone when a debt collector calls. Talk to Credit Saint.

Let's personalize your content