How Consumer Credit Trends Impact Debt Collection in 2024

True Accord

MARCH 5, 2024

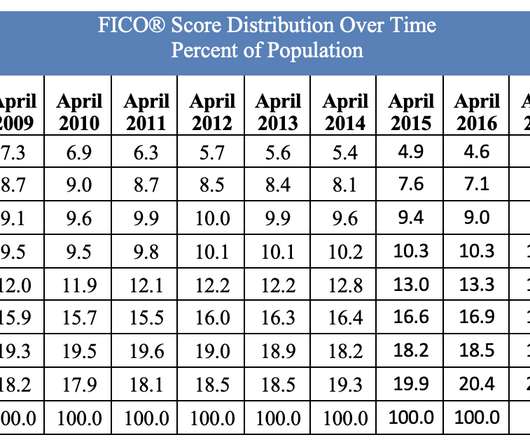

Bottom line: households took on more debt at the end of last year and we’re seeing loans increasingly going bad, according to data from the Federal Reserve Bank of New York , leading to a shift in consumer spending for 2024.

Let's personalize your content