Personal Loans Statistics

Credit Corp

APRIL 26, 2021

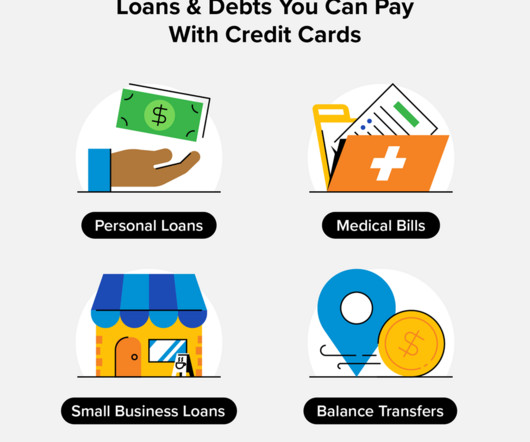

to consolidate debt, $5,448.03 While online lending has become increasingly popular, more people are going to banks than any other type of lender–regardless of gender or age. of Americans with personal loans borrowed from a bank. Both genders favored traditional banks for getting their personal loan.

Let's personalize your content