Personal Loans Statistics

Credit Corp

APRIL 26, 2021

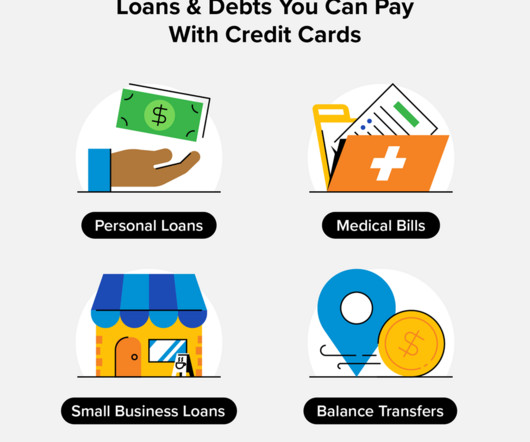

The top reason Americans were borrowing in January 2021 was to get out of debt. Some 37.17% of people surveyed who reported ever taking out a personal loan said they used the funds for debt consolidation. to consolidate debt, $5,448.03 of Americans with personal loans borrowed from a bank.

Let's personalize your content