How to Check Your Credit Report for Identity theft

Credit Corp

MAY 23, 2021

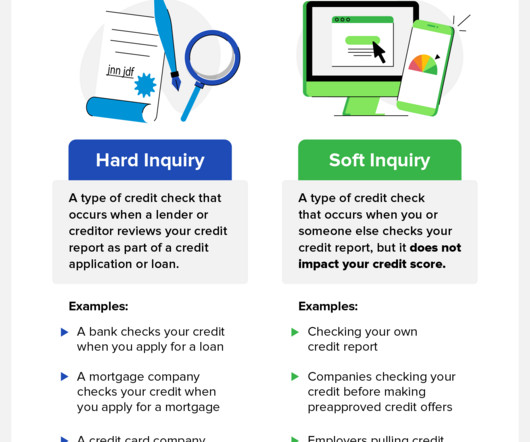

Incorrect Personal Information Lender Inquiries You Don’t Recognize Accounts You Never Opened Credit Utilization Goes Up Credit Score Goes Up or Down Unexpectedly Public Records You Don’t Recognize. How Do I Check My Credit for Identity Theft? Warning Sign 2: Lender Inquiries You Don’t Recognize.

Let's personalize your content