Can You Get a VA Loan With Bad Credit?

Credit Corp

JANUARY 24, 2024

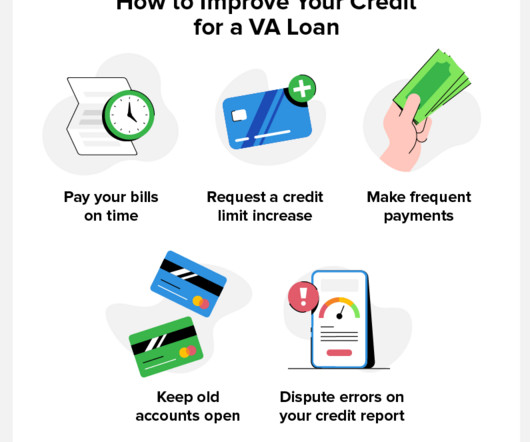

While there is no minimum requirement, most lenders prefer a credit score of 620 or above. A VA home loan is a mortgage backed by the Department of Veterans Affairs (VA) for service members, veterans, and their families. The purpose of VA loans is to help veterans purchase homes with lower interest rates and better terms.

Let's personalize your content