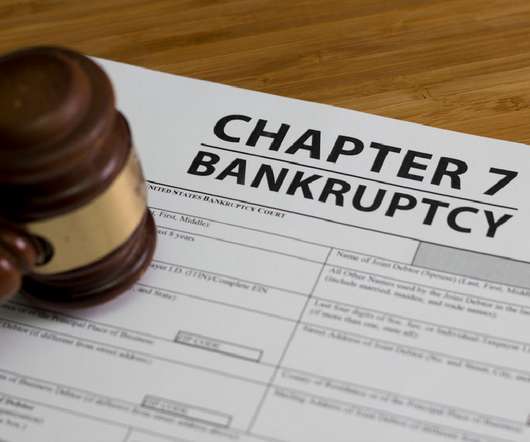

What Assets Do You Lose in Chapter 7?

Sawin & Shea

APRIL 10, 2024

Chapter 7 bankruptcy is a great financial solution for those struggling with debt, especially unsecured debts. With Chapter 7 bankruptcy, you as the debtor can discharge most unsecured obligations after liquidating nonexempt assets. For experienced bankruptcy lawyers in Indiana, contact Sawin & Shea, LLC.

Let's personalize your content