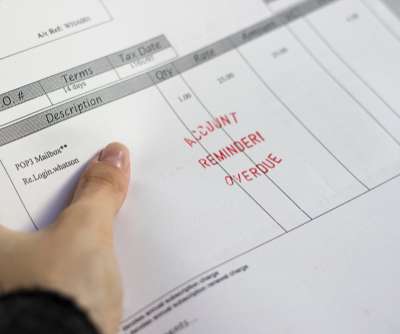

Dealing with Debt Collectors

Debt Free Colorado

FEBRUARY 21, 2022

Lenders, creditors, finance businesses, and payday lenders are all required by the UCCC to inform consumers about the cost of credit so that they can shop around for the cheapest rates. Except for requirements that lenders disclose the cost of credit and provide customers with limited legal remedies if the UCCC is breached.

Let's personalize your content