Q2 Industry Insights: Higher Monthly Expenses for Consumers, Regulatory Guidance for Financial Institutions

True Accord

JULY 13, 2023

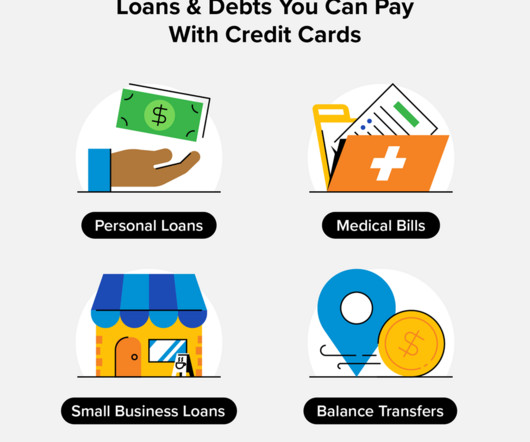

Breaking this down, auto loan account originations were up 0.7%, first mortgages were up 18.2%, while personal loans, HELOCs and second mortgages all grew significantly as well. For lenders or collectors engaging with distressed borrowers, here are ways digital can boost your efforts: 1. increase month over month in May.

Let's personalize your content