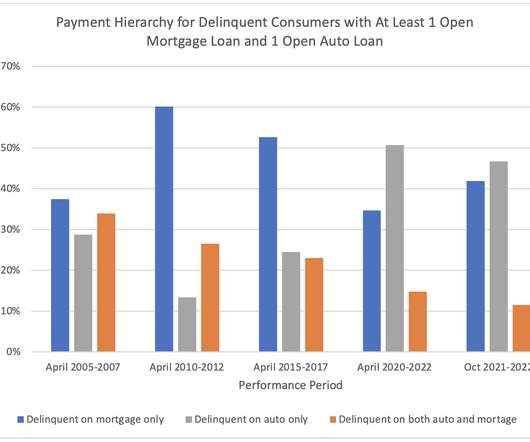

Consumers Prioritize Mortgage Payments Over Auto

Fico Collections

FEBRUARY 10, 2023

NicholetteLarsen@fico.com Tue, 03/23/2021 - 22:16 by Tommy Lee Senior Director, Analytics and Scores expand_less Back To Top Fri, 02/10/2023 - 16:00 At the start of the pandemic, unemployment spiked and the CARES Act was passed to support those in financial need to pay their bills, including mortgage and auto loans. and internationally.

Let's personalize your content