Average credit card debt statistics in the U.S. for 2023

Credit Corp

FEBRUARY 21, 2023

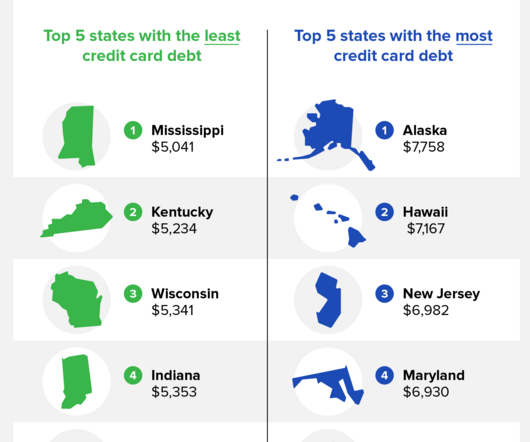

The average household credit card debt in America is $9,260, and the states with the largest amount of credit card debt are Alaska, Hawaii, and New Jersey. Between the first and final quarter of 2022 , TransUnion® reported that the average American’s credit card debt rose roughly $400 per person.

Let's personalize your content