Q1 Industry Insights: Consumers Will Consume, Lenders Will Lend, Delinquencies Will Rise

True Accord

MARCH 31, 2022

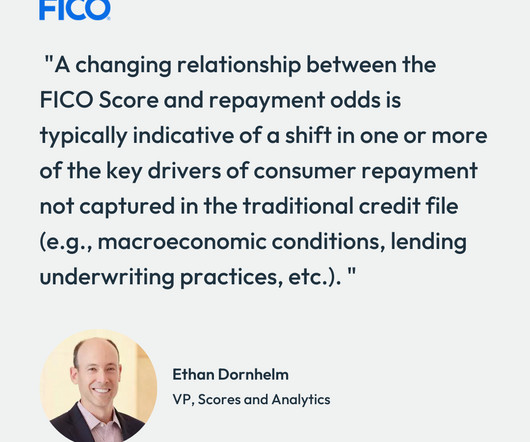

Add these all together and the financial outlook for consumers, especially those in debt, is scary. For one, the consumer credit market is looking strong with signs of expansion, specifically, originations for credit cards and personal loans are increasing. And lenders are happy to lend.

Let's personalize your content