How Consumer Credit Trends Impact Debt Collection in 2024

Collection Industry News

MARCH 19, 2024

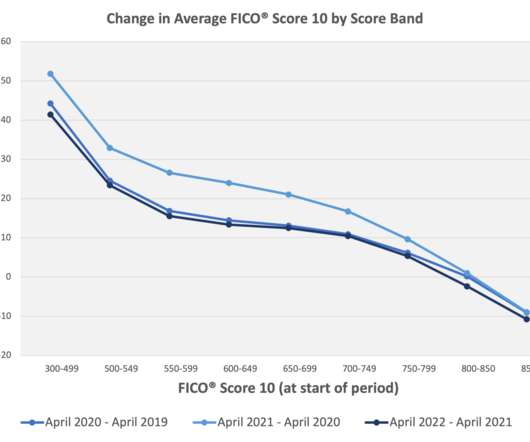

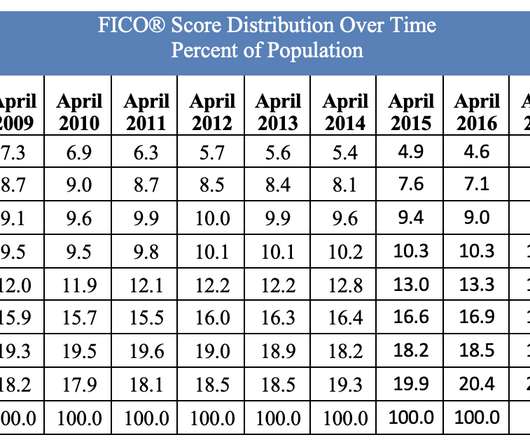

Today, about 61% of American households have credit card debt and the average credit card debt balance sits at $5,875. On top of historic credit card balances, delinquencies continue to climb across the board: automotive, mortgage, bank cards, and unsecured personal loans.

Let's personalize your content