How to Stop Capio Partners

Debt Collection Answers

MAY 18, 2023

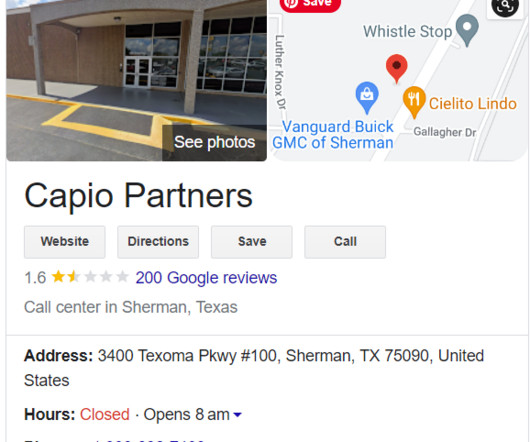

Capio Partners is one such agency that focuses on debt collection in the medical field. This is especially relevant due to multiple consumer complaints alleging violations of the Fair Debt Collection Practices Act (FDCPA) against this agency. This company may also collect other types of debt.

Let's personalize your content