Bill Introduced in Congress to Expand FDCPA to Cover Small Businesses

Account Recovery

FEBRUARY 23, 2022

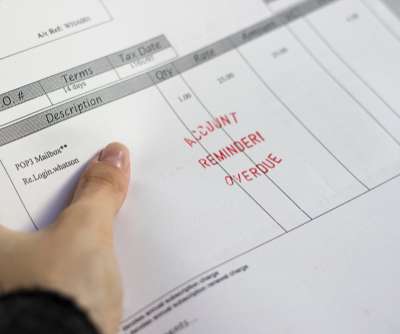

A bill has been introduced in Congress that would expand the Fair Debt Collection Practices Act to cover small business debts in order to protect those companies from “harassment” by third-party debt collectors, according to the bill’s sponsor.

Let's personalize your content