Impact of The GLBA on Collection Agencies

Nexa Collect

NOVEMBER 26, 2022

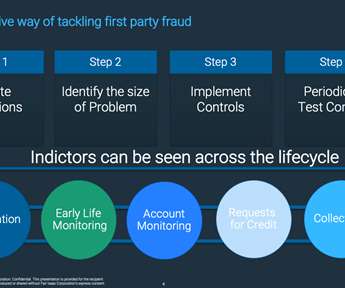

As per FTC, starting June 9, 2023 all collection agencies will be treated as financial institutions. This means all collection agencies must secure consumer data nearly the same way as banks. Failure to comply with GLBA can have severe consequences for the collection agency, especially the owners and/or the CEO.

Let's personalize your content