Selling your debt vs. hiring a debt collection agency

True Accord

JUNE 25, 2020

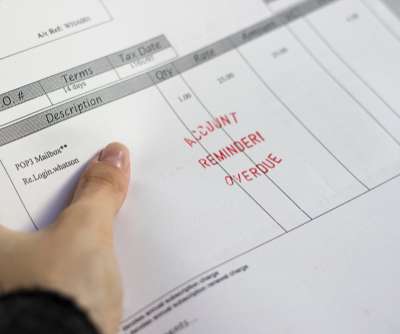

Debt sales play a unique role in the collections industry, as choosing between selling to a debt buyer and placing accounts with a third-party debt collector can make or break a brand. What is a debt buyer? Selling your debt to a debt buyer. Pros of selling your debts.

Let's personalize your content