Selling your debt vs. hiring a debt collection agency

True Accord

JUNE 25, 2020

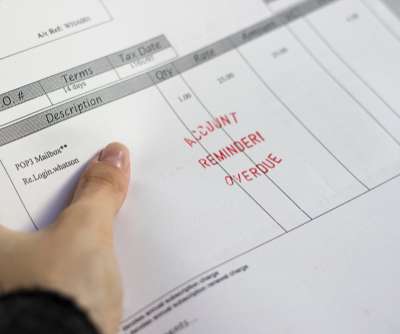

Debt sales play a unique role in the collections industry, as choosing between selling to a debt buyer and placing accounts with a third-party debt collector can make or break a brand. A debt buyer is a company that purchases debt from lenders for a fraction of the full value of those accounts.

Let's personalize your content