What Is a Signature Loan?

Nerd Wallet

JUNE 22, 2021

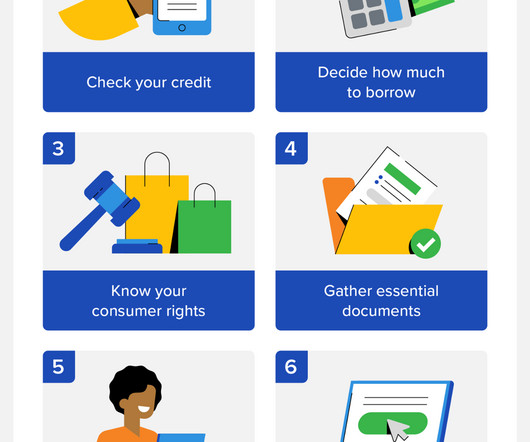

A signature loan is a fixed-rate, unsecured personal loan offered by an online lender, bank or credit union. It’s called a signature loan because it’s secured by your signature instead of collateral, like a car or an investment account. Getting approved for a signature loan will likely depend on your creditworthiness.

Let's personalize your content