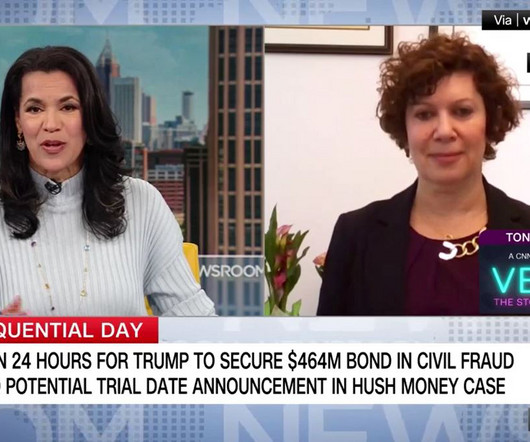

Unlawful Freezing of Bank Accounts Requires Bank To Refund Monies With Penalties

FFGN COLLECT NY

MAY 8, 2024

In April, following an investigation by Attorney General Leticia James’ office, Pathward (formerly known as MetaBank) was required to refund money to account holders after unlawfully sending frozen deposits to creditors. In addition to refunding the monies, the bank also had to pay penalties for the unlawful freezing of the bank accounts.

Let's personalize your content