Dealing with Debt Collectors

Debt Free Colorado

FEBRUARY 21, 2022

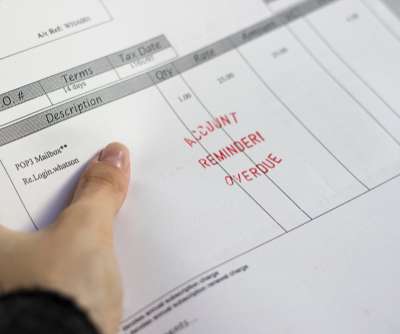

Debt Relief Attorney Serving Colorado. Bankruptcy may appear to be a scary process, but it does not have to be. Dray Legal Office’s attorneys will endeavor to help you obtain a fresh start by eliminating debt and reorganizing your finances. In this article we will answer the question: What can debt collectors do to you?

Let's personalize your content