Final Income Tax Numbers Offer Little Solace to ARM Industry

Account Recovery

APRIL 24, 2023

The post Final Income Tax Numbers Offer Little Solace to ARM Industry appeared first on AccountsRecovery.net.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

tax income

tax income

Account Recovery

APRIL 24, 2023

The post Final Income Tax Numbers Offer Little Solace to ARM Industry appeared first on AccountsRecovery.net.

Fraser

DECEMBER 12, 2022

For tax years beginning in 2022, research and experimental (R&E) expenditures are no longer immediately expensed but rather must be amortized over five years (15 years for foreign expenditures). To illustrate, if a business spent $1,000 on domestic research activities in 2021, it could deduct the full $1,000 on its 2021 tax return.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd Wallet

DECEMBER 2, 2021

Living in a state with no income tax is one strategy for lowering your overall tax burden. As of 2021, eight states — Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming — do not levy a state income tax. A ninth state, New Hampshire, does not tax earned income, but it does impose.

Nerd Wallet

APRIL 8, 2021

If you itemize deductions on your income taxes, Medicare costs, such as premiums and copayments, may be deductible. of your adjusted gross income. The article Can I Deduct Medicare Costs on My Income Tax? Premiums for Medicare Part B and Part D. Premiums for Medicare Part B and Part D.

Nerd Wallet

FEBRUARY 26, 2022

The article If Your Life Changed in 2021, Watch for Income Tax Surprises originally appeared on NerdWallet. A lingering pandemic, a shifting government response and a wave. Andy Rosen writes for NerdWallet. Email: arosen@nerdwallet.com. Twitter: @[link].

Nerd Wallet

FEBRUARY 23, 2022

Settling up with the IRS at tax time can be complicated if you’ve been doing a lot of cryptocurrency trading. Gains from sales of digital assets can be subject to capital gains tax. Unlike stockbrokers, even the best crypto exchanges aren’t always required to file tax forms summarizing your annual activity. It’s on you to.

Prosperity Now

APRIL 26, 2021

Millions of low-income Americans work hard for wages but face obstacles in filing their taxes. In cases where people don’t

Debt

OCTOBER 23, 2020

Your company sent everyone home when the pandemic began last March and now that is your workplace so you’re probably wondering if that means you’re eligible for some serious tax breaks when you file next April 15.

Prosperity Now

JULY 26, 2021

Earned Income Tax Credit (EITC) recipients typically earn less than $20,000 per year—yet they are more likely to be audited

PBWT

AUGUST 7, 2020

In an appeal of a bankruptcy court’s decision, a district court judge recently addressed the treatment of the “straddle year” for federal income tax under the Bankruptcy Code, which “does not appear to have been decided by any appellate court.” ” In re Affirmative Ins. Holdings Inc. United States v.

Account Recovery

MARCH 1, 2024

In what could be bad news for companies across the accounts receivable management industry, a significant number of fewer consumers are choosing to use their income tax refunds to pay down their debts, instead opting to boost their savings, according to the results of a survey conducted by Bankrate.

Account Recovery

MARCH 13, 2023

We are in the throes of income tax season and there are a growing number of indicators — including reports from different collection operations across the country — that this year’s income tax refund season is going to be less bountiful than the industry has seen in recent years.

Account Recovery

FEBRUARY 22, 2022

Income tax season is not just a boon for companies in the accounts receivable management industry; it’s also usually a bonus for consumers, too. This year, though, could be different, thanks to a variety of economic and pandemic-related factors that may make tax returns less bountiful than usual.

Burr Forman

AUGUST 5, 2020

South Carolina enacted a state low income housing tax credit on May 14, 2020. Projects must comply with all of the following in order to claim the state LIHTC: The project must qualify for the federal low-income housing tax credit. An overview of the credit, which mirrors the federal credit, can be found here.

Account Recovery

MARCH 24, 2022

The pace of income tax returns that have been filed with the Internal Revenue Service is slowing down, compared with last year, but the size of the average income tax refund remains significantly higher, further confounding members of the accounts receivable management industry, who had expected tax refunds for 2021 to be lower than usual, … (..)

Account Recovery

MARCH 7, 2022

There is good news and bad news about income tax filing season. The good news is that the average refund through the first month of income tax season is 15% higher than the average refund through the same period a year ago.

Account Recovery

MARCH 15, 2021

Fewer people plan to use their income tax returns this year to pay down debt or catch up on bills and will instead put that money away for a rainy day or make a big purchase like a car or house, according to the results of a survey released by NerdWallet.

Account Recovery

JANUARY 13, 2022

I’ve included a couple of links and references in the “Worth Noting” section of The Daily Digest this week with details about income tax returns, but wanted to put everything together and share access to a webinar recording on the topic of how companies in the ARM industry should be approaching tax season this year.

Prosperity Now

FEBRUARY 1, 2022

Tax filing season just started, and taxpayers are—once again—in for a rough ride. For starters, the Internal Revenue Service (IRS)

Account Recovery

DECEMBER 20, 2023

government out of more than $3 million in taxes on income that was earned running a debt collection scam that bilked millions from unsuspecting individuals. A federal judge yesterday sentenced Greg MacKinnon to three years in prison for defrauding the U.S.

Nerd Wallet

MARCH 21, 2023

Virginia state income tax rates are 2%, 3%, 5% and 5.75%. Virginia state income tax brackets and income tax rates depend on taxable income and residency status. Virginia state income tax rates and tax brackets Tax rateTaxable income bracketTax owed 2%$0 to $3,000.2%

Credit Corp

APRIL 8, 2024

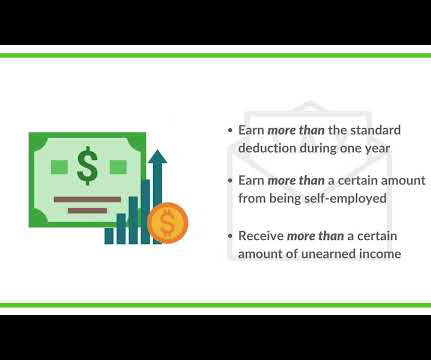

[This is a guest post contributed by Jessica Chung, Programs Director at FitMoney] Millions of Americans will file their taxes this spring, but for many, they’ll be first-time filers. Filing taxes can be really confusing, especially for those filing for the first time. Start with a discussion of what students already know.

Credit Corp

APRIL 26, 2024

The 1099 c form helps the IRS account for canceled debts from the previous tax year. The 1099-C cancellation of debt form deals with canceled or forgiven debt from the previous tax year. This form exists to ensure accuracy when reporting taxes and to help filers determine if they owe debt forgiveness taxes.

Prosperity Now

SEPTEMBER 13, 2021

On September 15, millions of families will receive the third installment of the monthly Child Tax Credit (CTC) payments that

Credit Corp

APRIL 12, 2023

Guest Post by FitMoney As a parent of a teenager or young adult, you want to ensure that your child is financially secure and understands the importance of taxes. Filing taxes can often be confusing and intimidating, but it’s an important part of life when you start earning income.

Credit Corp

FEBRUARY 9, 2023

How are bonuses taxed, and how much will the IRS take out of your bonus? Keep reading to learn more about how bonuses are taxed and what steps you can take to minimize this tax burden. how are bonuses taxed In This Piece How Are Bonuses Taxed? The IRS views bonuses as a form of income.

Prosperity Now

JANUARY 21, 2024

The VITA Leadership Institute (VLI) aims to train a diverse class of ten emerging VITA leaders to build their capacity to expand and scale free, high-quality, and racially equitable tax preparation services for low-income taxpayers in their communities.

Sawin & Shea

MARCH 20, 2024

You may be wondering whether you should opt for a tax attorney or a bankruptcy attorney. This page addresses the most common questions about selecting the right attorney to help you address your tax problems and other financial concerns. What’s the Difference Between a Tax Attorney and a Bankruptcy Attorney?

Nerd Wallet

MARCH 5, 2021

New York state tax rates are 4%, 4.5%, 5.25%, 5.9%, 6.09%, 6.41%, 6.85% and 8.82%. New York state tax brackets and income tax rates depend on taxable income and filing status. New York City and Yonkers have their own local income tax on top of the state tax. Tina Orem writes for NerdWallet.

Nerd Wallet

SEPTEMBER 16, 2021

Virginia state income tax rates are 2%, 3%, 5% and 5.75%. Virginia state income tax brackets and income tax rates depend on taxable income and residency status. Virginia state income tax rates and tax brackets Tax rateTaxable income bracketTax owed 2%$0 to $3,000.2%

Credit Corp

FEBRUARY 9, 2024

After a long year, tax season is finally upon us. You’re probably getting all your ducks in a row—collecting all the information you need, choosing your tax software, and so on. If you’re a homeowner, you might be able to catch a few tax breaks—but can you get a tax break for buying a house?

Burr Forman

DECEMBER 13, 2021

South Carolina businesses have historically been subject to business license taxes on their gross income that vary widely from jurisdiction to jurisdiction. The South Carolina Business License Tax Standardization Act (the “Act”) was enacted in 2020, but the effective date was generally delayed until January 1, 2022.

Nerd Wallet

OCTOBER 6, 2022

Several states are poised to collect income taxes on student loan forgiveness — a move that could leave some borrowers owing as much as $1,000 during tax season. The article Will Your State Tax Your Canceled Student Debt? Cara Smith writes for NerdWallet. Email: cara.smith@nerdwallet.com.

Nerd Wallet

APRIL 23, 2021

If your small business has employees, your business tax obligations include reporting the income and payroll taxes that you withhold from their paychecks. Typically, this information is reported using IRS Form 941, also known as the Employer’s Quarterly Federal Tax Return. Randa Kriss writes for NerdWallet.

Prosperity Now

JANUARY 26, 2022

The Earned Income Tax Credit (EITC) is one of the nation’s largest anti-poverty programs. Because of this, Volunteer Income Tax

Sawin & Shea

JULY 29, 2020

One of the things that people hear about bankruptcy is that it usually doesn’t discharge some debts owed to the government, like taxes. Even if you have a large burden of tax debt that is making it extremely difficult to reconcile your finances, bankruptcy can’t always help. How Can I Wipe Out My Tax Debt?

Nerd Wallet

JANUARY 28, 2021

Families battered by the pandemic recession soon may discover that the tax refunds they’re counting on are dramatically smaller — or that they actually owe income tax. Refunds are crucial to many lower- and moderate-income households, which use the money. Liz Weston writes for NerdWallet. Liz Weston writes for NerdWallet.

Nerd Wallet

APRIL 19, 2021

Unlike individual taxpayers who only have to file one tax return per year, most businesses are required to file quarterly tax returns. Priyanka Prakash writes for NerdWallet.

Nerd Wallet

JULY 17, 2021

No entrepreneur looks forward to filing their business taxes, but everyone looks forward to saving on their tax bill. Now small businesses and self-employed people may be eligible for a big tax break: the qualified business income deduction. The article What Is a Qualified Business Income Deduction?

Prosperity Now

JULY 13, 2022

For the past 42 years, Tax Help New Mexico has provided tax preparation services for low-income and elderly New Mexicans.

Sawin & Shea

JANUARY 19, 2022

Filing your taxes and filing for bankruptcy are two things that can be confusing and challenging on their own. Filing your taxes after filing for bankruptcy is not as complicated as it may seem, and if you are still confused after doing some research, you can always reach out to a bankruptcy lawyer. Tax Debt and Bankruptcy.

UK debt collections

JANUARY 28, 2024

A spokesperson said they wouldn’t comment on individual cases, but told the Daily Mirror newspaper: “We take a supportive approach to dealing with customers who have tax debts , and do everything we can to help those who engage with us to get out of debt, such as offering instalment plans.”

Credit Corp

MAY 3, 2021

NOTE: Due to the COVID-19 coronavirus pandemic, the IRS has extended the federal tax filing and payment deadline to May 17, 2021. The recent relief package passed by Congress may have additional tax implications. Please contact a tax adviser for information you may need to complete your taxes this year. Learn More.

Credit Corp

NOVEMBER 1, 2023

To help offset the costs and help Americans avoid crippling medical debt , the federal government offers tax relief for those with high-deductible plans if they choose to open a Health Savings Account to set aside funds to pay for medical costs. Like FSAs, HSAs provide tax benefits; however, HSAs are not available to everyone.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content