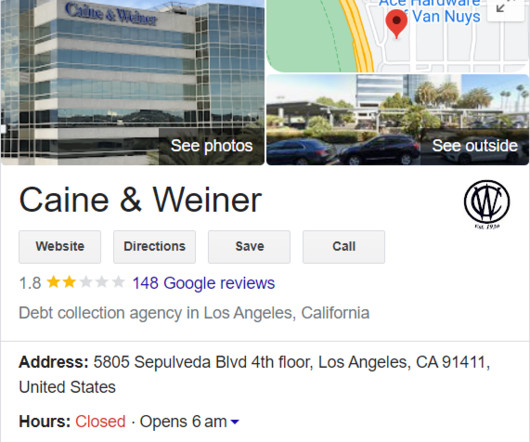

What is Caine and Weiner?

Debt Collection Answers

MAY 18, 2023

Having a collections account from Caine and Weiner on your credit report can damage your credit score and make obtaining loans and other financial activities difficult. Caine and Weiner specialize in reporting collections accounts on credit reports. However, you may not have to pay your debt and risk further damage to your score.

Let's personalize your content