How Effective Are Collection Agencies?

Nexa Collect

AUGUST 8, 2020

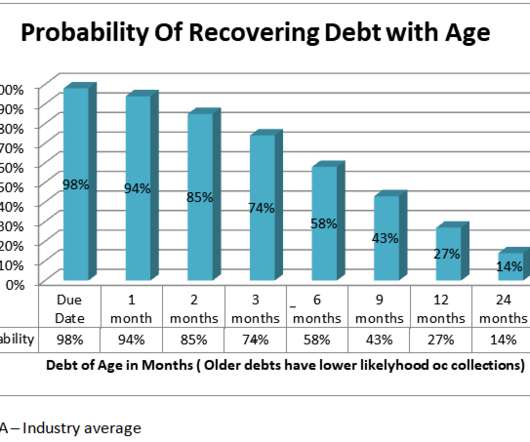

When a debt passes from the original creditor to a collection agency, this escalation often makes debtors pay attention. There’s an implied threat when an agency gets involved that doesn’t exist with the original creditor. These are all benefits not afforded to the original creditor.

Let's personalize your content