CCS Offices

Debt Collection Answers

MAY 18, 2023

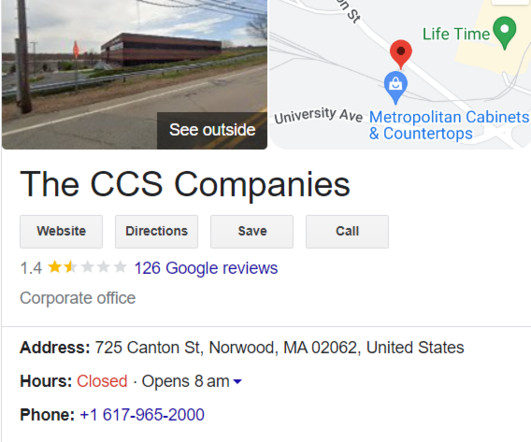

CCS Offices works as a third-party recovery service for clients seeking to collect unpaid debts from sources such as banks, financial institutions, and credit unions. This agency collects debts on behalf of creditors or by acquiring debts from creditors.

Let's personalize your content