Enterprise Debtor Payment Portal

SimplicityCollectionSoftware

FEBRUARY 6, 2017

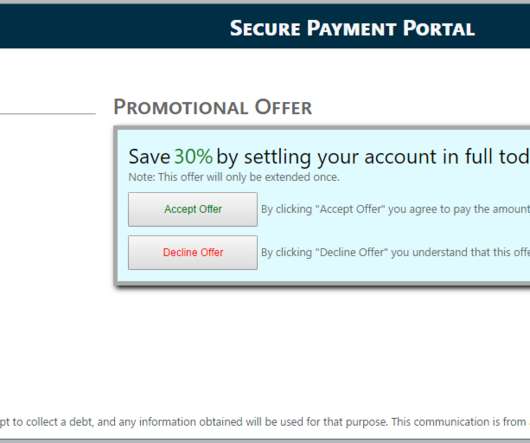

Simplicity Debt Collection Software is pleased to announce the roll out of its new Enterprise Debtor Payment Portal. This fully functional portal allows you to empower your debtors to make payments, settle accounts, set up payment plans, confirm their information and so much more. Use this application easily from your own website or direct them to our portal, either option is now available.

Let's personalize your content